How do I Profit from Pre-Foreclosures Using the Wholesale Method?

How to Profit from Pre-Foreclosures Using the Wholesaling Method

For real estate investors seeking quick returns without extensive renovations, wholesaling pre-foreclosures presents a compelling opportunity. This strategy involves finding motivated homeowners eager to sell, securing the property under contract, and quickly assigning that contract to another buyer for a profit. Let’s delve into the steps involved in this process and learn how to turn these distressed properties into lucrative deals.

Understanding Wholesaling: The Basics

Wholesaling, in essence, eliminates the need to take ownership of a property. Here’s how it works:

-

Locate a Property with Potential: You focus on finding properties priced below market value, often those in pre-foreclosure.

-

Negotiate a Contract: You negotiate a purchase contract with the current owner (the homeowner).

-

Find a Buyer: You market this contract to an investor or cash buyer interested in purchasing the property.

-

Assign the Contract: For a fee, you assign your rights in the purchase contract to your buyer. They then complete the purchase directly with the homeowner.

The Advantages of Wholesaling Pre-Foreclosures

-

Motivated Sellers: Owners in pre-foreclosure are often under financial pressure and open to negotiating a quick sale to avoid a formal foreclosure on their credit.

-

Below-Market Opportunities: This sense of urgency can lead to securing properties significantly below market value, leaving ample room for profit.

-

Speed and Simplicity: Wholesaling pre-foreclosures often results in faster closing times compared to traditional purchases, as you bypass the listing and showing processes.

Step-by-Step Guide to Success

1. Finding Pre-Foreclosure Properties

- Public Records: Search county clerk websites for “Notice of Default” (NOD) or “Notice of Trustee Sale” (NTS) filings.

- Pre-Foreclosure Listing Services: You’re in the right place! We offer targeted foreclosure leads for all of Texas, saving you time on research.

- Driving for Dollars: Look for properties in your target neighborhoods that show signs of neglect or disrepair, which might indicate financial distress.

- Direct Mail or Outreach: Sending letters or making phone calls to homeowners in pre-foreclosure is another way to find potential sellers.

2. Essential Due Diligence

- Title Search: Before contacting the homeowner, order a title search to ensure the seller has legal rights to sell and uncover any liens or hidden debts against the property.

- Assess Repairs: If possible, estimate the extent of needed repairs, factoring these into your offer and potential resale value.

- Market Analysis: Research recent comparable sales to understand the property’s potential after-repair value (ARV).

3. Making Contact with the Homeowner

- Empathy is Key: Approach with sensitivity. Understand homeowners in this situation are often facing emotional and financial turmoil.

- Focus on Solutions: Present yourself as someone who can help them avoid the damaging consequences of a full foreclosure.

- Transparent Communication: Explain the wholesaling process clearly, emphasizing the potential for a quick sale and how it could benefit them.

4. Negotiating and Securing the Contract

- Price Strategically: Aim for a purchase price that offers a win-win: attractive for the seller and allows you sufficient room to market the deal profitably.

- Contract Contingencies: Protect yourself with essential contingencies like financing and inspection periods.

- Earnest Money Deposit: Be prepared to submit earnest money along with the contract to solidify your commitment.

5. Finding Your End Buyer

- Build Your Network: Proactively develop connections with investors, flippers, and cash buyers interested in pre-foreclosure deals.

- Effective Marketing: Advertise your contract on relevant online platforms, through real estate groups, and directly within your network.

- Highlight the Value: Emphasize the property’s below-market price, estimated ARV, and the opportunity for your buyer to turn a profit.

6. Assignment and Closing

- Your Assignment Fee: This is where you generate your profit. It’s the difference between your contracted price with the homeowner and the price you assign the contract for to your end buyer.

- Coordinate the Closing: A title company or real estate attorney can ensure all paperwork is accurate and the transaction closes smoothly.

Additional Tips for Success

- Understand Regulations: Research Texas-specific laws and any local regulations governing wholesaling.

- Prioritize Ethical Practices: Be transparent with both homeowners and buyers. Building a reputation for honesty is crucial for long-term success.

- Speed Matters: Move quickly throughout the process. Motivated sellers and investors seeking pre-foreclosures often prioritize fast transactions.

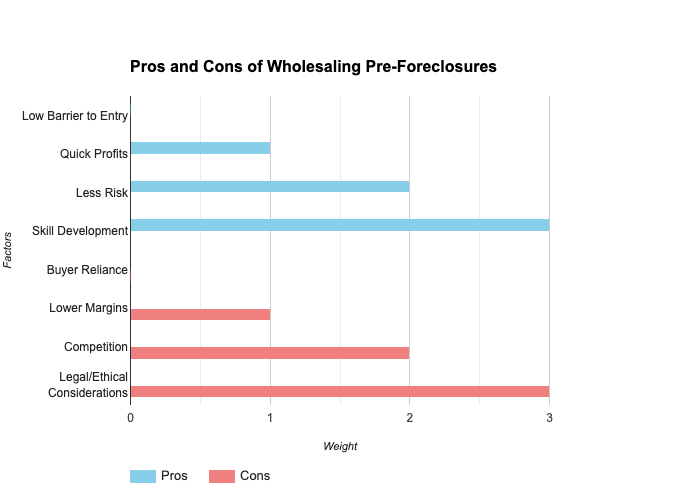

Pros of wholesaling real estate:

• Low barrier to entry: Wholesaling real estate can be started with very little capital, making it an attractive option for new investors. You don’t need to have any experience in real estate or construction, and you don’t need to have a large amount of cash on hand.

• Quick profits: Unlike flipping houses or buying rental properties, wholesaling can generate profits relatively quickly. Once you find a motivated seller and a willing buyer, you can typically close the deal within a few weeks or months.

• Scalable business: Wholesaling can be a very scalable business. As you gain experience and develop a network of buyers and sellers, you can close more deals and make more money.

• Flexibility: Wholesaling can be done from anywhere in the world, and it can be done on a part-time or full-time basis. This makes it a great option for people who want to be their own boss and set their own hours.

Cons of wholesaling real estate:

• Limited profits: Wholesalers typically make a profit of 5-10% of the purchase price of a property. This is significantly less than the profit that can be made from flipping houses or buying rental properties.

• High competition: Wholesaling is a very competitive business, and it can be difficult to find motivated sellers and willing buyers.

• Requires marketing skills: Wholesalers need to be able to effectively market their services to both sellers and buyers. This can be a challenge for people who are not comfortable with marketing.

• Requires due diligence: Wholesalers need to be able to do their due diligence on properties before they make an offer. This includes researching the property’s condition, history, and market value.

Overall, wholesaling real estate can be a great way to get started in real estate investing.

It is a low-risk strategy that can be done with minimal upfront capital and can be a quick way to make profits.

However, it is important to be aware of the challenges involved in wholesaling, such as the low

profit margins and the competitive market. Wholesaling is not a get-rich-quick scheme, but it can

be a rewarding and profitable investment for those who are willing to work hard and dedicate

themselves to it.

Here is a table summarizing the pros and cons of wholesaling real estate: